For decades I’ve been entrusted with the confessions of people preoccupied by their inability to feel adept in handling their finances.

These individuals come from all walks of life, possess various levels of education, and span a wide range of household income. They are all smart and successful in certain areas of their lives, but when it comes to investing to meet their financial goals, suddenly all competency goes out the window – at least from their perspective. I say it’s more of a self-fulfilling prophecy.

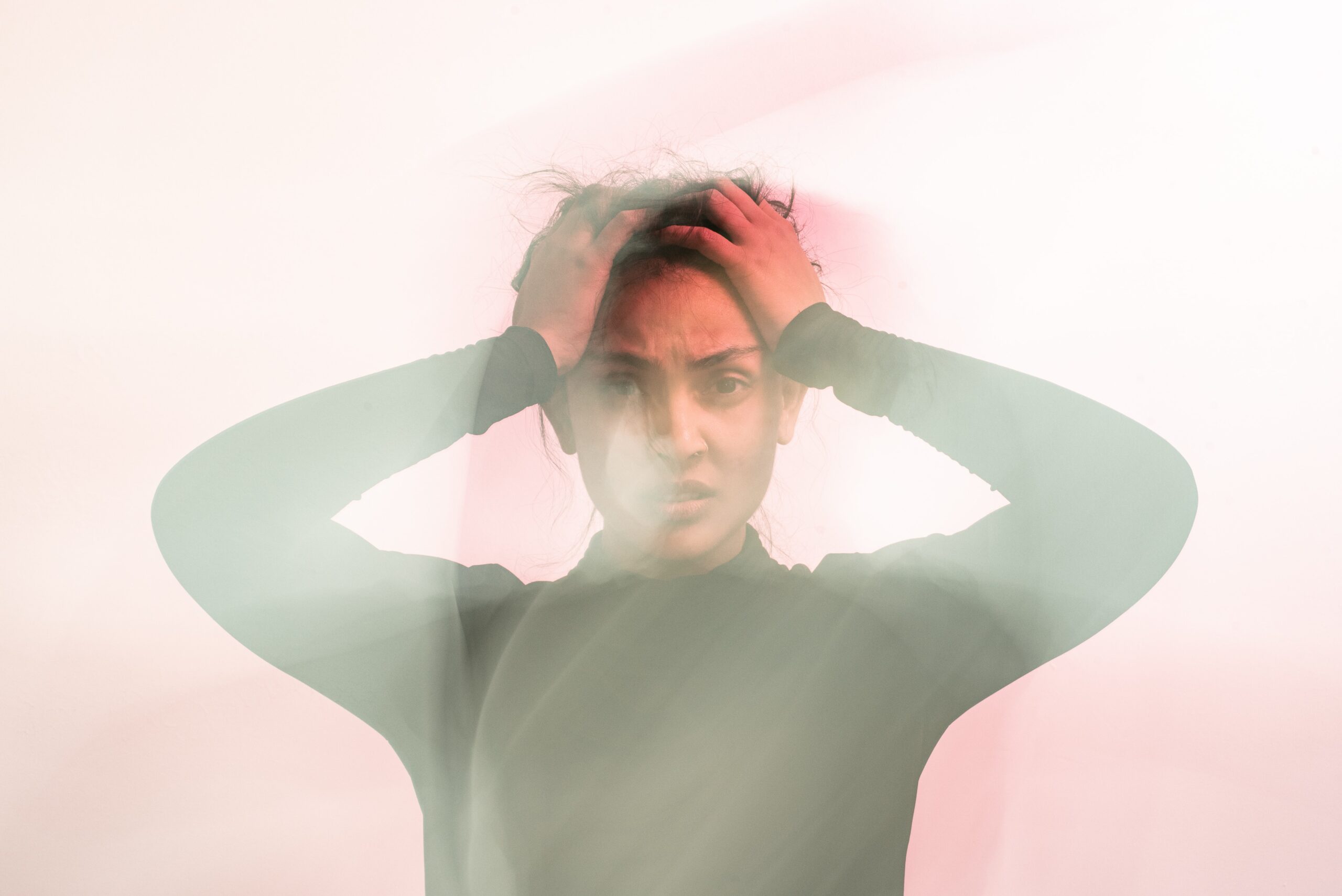

How can you stop being your worst enemy? First, recognize the ways you sabotage yourself:

Negative words have consequences. If you keep saying you are bad at math, horrible at finances, or too stupid (yes, I’ve had people use those exact words) – how can you possibly improve? Give your brain a “fact” to verify, and that’s just what it will do. Would you ever tell a loved one, especially a child, that they were too stupid to learn something? So why would you doom yourself to a lifetime of low financial self-esteem? Reframe the question to: What can I do to become more confident/skilled at dealing with my money?

Procrastination. You are not sure what to do, what goals to aspire to, or what sources of information to seek out, so you do nothing. Or you busy yourself with endless research, thinking that this “motion” is “action”. It’s not. It’s a stalling technique dooming you to a shame spiral when you have nothing to show for your efforts. Instead, give yourself a deadline to make a move, such as by the end of the month I will open an IRA.

When it comes to the nitty gritty of what I see investors doing wrong – it is all fixable. If you are guilty of any of these items, you are not the only one, even if it feels that way:

Not Investing for Retirement.

You have to start somewhere. While it might not be ideal to wait until you’re forty or fifty, guess what? Adding one more year to an already late start makes it that much harder. The more you delay, the more you have to save. Money needs time to compound.

The Fix: If you have access to a retirement plan at work (401(k), 403(b), etc.) participate in the plan. If your employer gives you a match, make sure you contribute as much as you can to at least get the match. IRAs and Roth IRAs are accounts you can fund on your own. Even non-working spouses can fund one of these accounts as long as one spouse works and taxes are filed jointly. You always have until Tax Day (April 15) to fund the previous year’s IRA or Roth, so don’t miss out on this grace period.

Not Investing Enough.

It can be hard to set aside 20% of your income for savings/investing, but you need to start somewhere. And, most important, you cannot be content with where you start. You must constantly challenge yourself to do more and work towards a 20% savings rate. Saving the same $100 per paycheck will not materially bolster your retirement account. But increasing your contribution amount/rate every year, will.

The Fix: If your 401(k) plan allows for an auto increase feature, where contributions go up every year, sign up for that. The more you can automate, the better. If you don’t have access to this feature, use your calendar to set up reminder alerts. If you are contributing a small amount, like $100 a paycheck – consider raising this by a dollar amount, such as $50.

Not Covering the Basics First.

When I first meet with a new prospective client, one of the first questions I ask is whether they have an emergency fund. It is surprising how many people want to start buying stocks (or worse, speculative investments like crypto) when they have not established a solid financial foundation first.

The Fix: Fund a high-yield savings account with three to six months’ worth of living expenses (more if you have fluctuating earned income or are self-employed). This simple act prevents you from sliding into credit card debt should an emergency arise that would destroy your monthly household budget. It also prevents you from taking a loan against your retirement account or facing a 10% early withdrawal penalty in addition to income taxes for withdrawing from an IRA before age 59 1/2.

Not Understanding the Difference Between Investment Risk and Volatility, and the Importance of Your Time Frame.

When choosing which vehicle to use to get you somewhere, it’s pretty easy. You might elect to take a bike for a short trip to a shop where parking is a nightmare, but you wouldn’t use that to go cross-country. A plane would make perfect sense for long-distance travel but would be overkill if you were going a few towns away. Investments are similar. Cash is designed to keep your money safe, not to grow it. Its stability is an asset, when you have a short-term goal (five years away, for example), but a negative if you are trying to save for the long term (the risk being you won’t reach your goals). Stocks are incredibly volatile day-to-day, but over extended periods (ten years or more) they are less so. If your goal is far into the future, volatility is the price you pay to improve your portfolio’s chances to outpace inflation.

The Fix: Look at your goals first. Break them into categories by time frame – under five years, eight to ten years, more than ten years. Then plan for the investments. It might look like this:

| Goals 5 Years Away

(cash) |

Goals 8-10 Years Away

(balanced blend of stock/bond funds) |

Goals More than 10 Years Away

(stock/bond fund blend with more stock) |

| Emergency Fund | College Costs | Retirement |

| Home Purchase | Family Event – Wedding, etc. | Vacation Home |

| Car purchase |

Following Conflicted Advice, and Not Knowing the Costs.

Financial advice is very different from sales. Unfortunately, it is not clear to investors what they are getting, and the mistake can be costly. When you are being “sold” the conversation revolves around the product (because the product is paying the person selling it; consequently,the product fees tend to be high). You might also pay the person for the advice. When the person is a fee-only fiduciary, they are charged with finding you the best solution for your circumstances. It will be obvious what you are paying for this advice, as it is either a consultation or subscription fee or a percentage of your account balance. The investment costs are kept low because the advisor is not “getting a piece” of this. You and the fiduciary advisor have a common goal – to see the account grow; high fees are avoided because they impede that goal.

The Fix: Never invest with someone when they have not spelled out the costs in writing (advisor fees, investment fees, surrender charges, M&E fees, wrap fees, etc.). Only work with an advisor whose goals align with yours.

Not Being Intentional with Goal-Setting.

To reach a goal, you have to actually set one, and measure your progress. Without that, you have a wish or an intention, and it usually gets you nowhere.

The Fix: Sit down with your partner, if you have one, and think about what goals you have. Segment them using the different time frames shown in the above table. How many of these accounts are you already funding? How much is in these accounts? How much are you contributing, and are you doing so, regularly? What is the amount you want in the account when you are ready to use the funds? Then work backward to determine how much you must contribute monthly to fund the goal. This is a reality check because you might find you must increase the time to reach the goal, add extra funds to achieve the goal, or revamp the goal entirely. Monitor your progress every month – tracking how much was put towards the goal. This simple act will have you using your cash as a precious resource with a designated purpose. Extra available cash suddenly will be intentionally directed toward your priorities.

Lastly, stop beating yourself up for your past mistakes or negligence. Use the fixes I’ve suggested to gain the confidence – and momentum – to make consistent improvements. Like dividends and interest, positive changes compound getting you closer to your goals.

Failing to change is the only thing standing in your way.

[…] To get your finances on track, first stop beating yourself up. (realsmartica.com) […]