It has been almost two years since Tony and I formally embarked on a mission to educate and free teachers from expensive and inappropriate investments in their 403(b) accounts. Our main message has been buyer beware.

A teacher, Chase Malia, has taken it a giant leap forward – proposing Resolution #41 to his union, NYSUT, which would affect all of the members, not just his district. The union acted to approve the resolution, which will protect members from financial predators by:

- Educating members about the importance of lowering investment fees;

- Providing members access to fee-only fiduciaries to provide un-conflicted advice;

- Advising members on how they can add low-cost options to their district’s provider list; and

- Seeking legislative action to offer fee-transparency and fiduciary protections that 401(k) participants currently enjoy.

Halleluiah!

Though this will all take time to get underway, it is a huge first step.

The good news is: If you are a teacher in NY, you do not need to wait for this undertaking to begin.

Tony and I, along with the help of motivated teachers, have been helping districts in NY improve their situation since 2016. Our educational presentation has empowered teachers to demand better options and to control what they can by:

- Explaining that they can choose to work with someone who puts their interests first (fiduciary) or settle for the suitability standard of insurance and financial salesmen.

- Showing them that low fees are an investor’s best friend and teaching them how to determine what they paid for investments and how the representative was paid.

- Informing them that the certainty of a pension is not enough to sustain a retirement that can last decades; investments are needed to grow assets to outpace inflation.

- Diversifying their portfolio to mitigate risk. A portfolio needs to have a variety of asset classes to endure varied market conditions.

- Reducing their taxable income by contributing to their 403(b).

I’m not going to lie – there have been times that I have lost faith in humanity, sickened by what I have seen done to unsuspecting teachers in the 403(b) arena, such as:

- Charges of 2.25% and as high as 4.25% that the investor was completely unaware of.

- Owning inappropriate annuities in a retirement account with surrender fees of thousands of dollars to get out.

- Contaminating other financial assets, such as a spouse’s IRA or a child’s college fund into these same atrocious, expensive broker-sold investments.

- Paying exorbitant prices for whole-life insurance policies that would barely provide enough coverage to replace a half a year’s worth of income.

- Owning speculative and illiquid investments, such as junk bonds and private REITs, which subject investors to unnecessary risks that, of course, were never explained.

Every awful product I have seen teachers own can be traced back to one common thread: A “nice” sales guy made a ton of money peddling this garbage.

In short, teachers have been paying Maserati prices for a Yugo (an obsolete car company that had the decency to stop production of its lemons in 2008).

And yet, there have been moments of great hope, as informed teachers have spread the word to their colleagues and newbies. Some have graciously shared their most embarrassing investing mistakes in order to spare someone an avoidable, costly mistake.

And some, like Chase, have demonstrated a tireless commitment to fairness; working unselfishly to get a better option for all.

Yes, my faith has been restored.

We’re here to help you, your colleagues and your district. To learn more, visit us or email me at dina@ritholtzwealth.com.

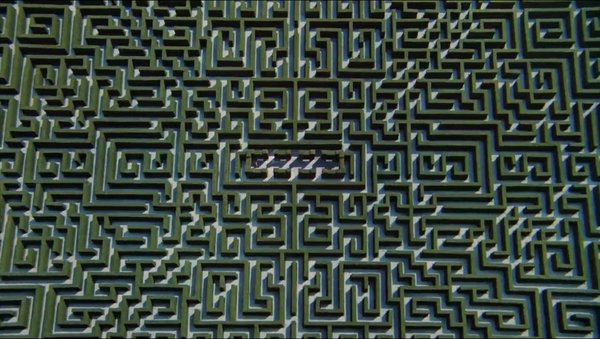

There is a way out of this dizzying maze. The question is: Are you ready?

7j0mim

nu4dmj